Credit Notes and Short Payments

Introduction

What are short payments and credit notes?

A Short Payment, sometimes known as a Short Payment Correction, refers to an adjustment made to an invoice to account for an underpaid invoice.

For example, let’s say you send someone an invoice for $1005. For some reason, they only pay $1000, leaving a balance of $5. This will leave the invoice with a status that indicates this invoice is not fully paid.

Sometimes the outstanding amount, in this case, $5, is not worth the trouble of trying to get the client to pay. So we can apply a Short Payment Correction to that invoice, in the amount of $5, and that invoice will now be marked as Paid, but in your reporting, it will show as only $1000 cash coming into the business, not $1005.

Short Payment Corrections

Here is how we can Apply a Short Payment Correction.

- Navigate to an invoice, and apply any payments, as you normally would.

- Once all payments have been applied, IF you have an outstanding balance that you are not worried about collecting, you can issue a Short Payment.

- Click on New Payment

- Enter the Amount

- Enter the Date

- In the CATEGORY drop down, select “Short Payment”

- Add a Note (Optional)

- Select “Send Email” to send a receipt to the client (Optional)

- Click Save

That’s It! You have now successfully added a Short Payment Correction to an underpaid Invoice!

Credit Notes

What is a Credit Note?

A Credit Note refers to credit given to a customer for various reasons.

One reason could be a referral credit, where your customer referred your company to another customer, and you thank them by giving them a “Store Credit” or credit note.

Another option could be a refund in the form of Store Credit. Maybe your client paid you in full, and when you went to complete the job, there was a small part of the job you could not complete, and instead of issuing a refund, your client agreed to accept “store credit” in the form of a credit note.

Or maybe a customer overpaid on an invoice, and instead of refunding them, you just decide to issue a Credit Note.

Whatever the case may be, Creating and Applying a Credit Note is easy to do in Tinsel.

Creating Credit Notes

You can create credit notes 2 ways, manually, and one way automatically.

- From the Client Page (Manual)

- Navigate to the Client Page

- Find the section labeled “Credit Notes”

- Click the New button

- Enter the Amount

- Enter the Reason

- Enter any Notes (Optional)

- Cash Exchanged Option

- Select this option if money was actually exchanged for this credit note (refund in the form of credit). Keep this option unchecked if money was not exchanged (referral credit, discount).

- Click Save

- Your Credit Note is now ready to be applied to an invoice!

- From the Invoice Page (Manual)

- Navigate to the Invoice Page

- Find the section labeled “Credit Notes”

- Click the New button

- Enter the Amount

- Enter the Reason

- Enter any Notes (Optional)

- Cash Exchanged Option

- Select this option if money was actually exchanged for this credit note (refund in the form of credit). Keep this option unchecked if money was not exchanged (referral credit, discount).

- Click Save

- Your Credit Note is now ready to be applied to an invoice!

- Creating a Credit Note from an Overpaid Invoice (Automatic)

- Navigate to the Invoice Page

- Find the section labeled “Payments”

- Click the New button

- Enter the payment Amount

- NOTE: If the payment amount is MORE than what is due, an additional field will appear that asks “Would you like to create a Credit Note?

- Selecting YES will automatically create a Credit Note for the amount that has been overpaid.

- Complete the rest of the fields as normal, and click Save.

- Your Credit Note is now ready to be applied to an invoice!

Applying Credit Notes

Applying Credit Notes is as simple as creating them!

- Navigate to an invoice with an outstanding balance

- Find the section labeled Credit Notes

- Click on the Credit note you would like to apply

- Enter the amount you would like to apply to this invoice.

- Click Apply

- You will now see your Credit Note applied as a Payment under the Payments section of the invoice.

Additional Information!

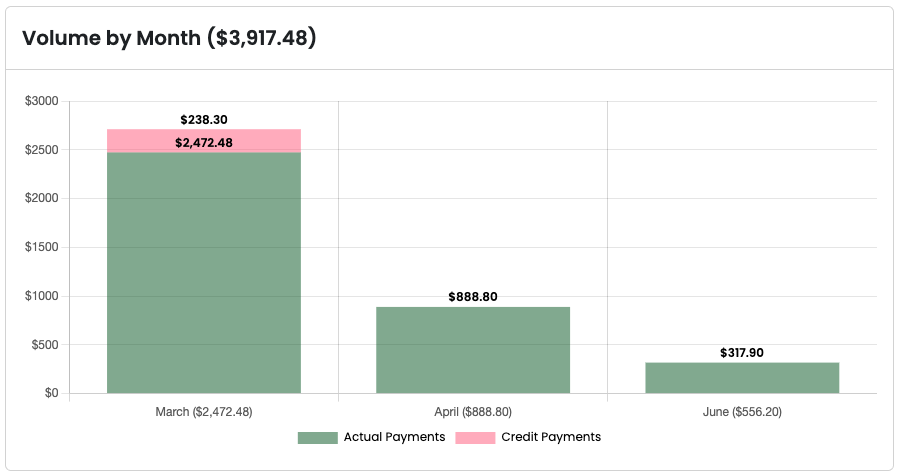

In the Payments Report, Short Payment Corrections and Credit Notes (where Cash Exchanged has NOT been selected) will display as “Credit Payments” to differentiate whether or not money was actually received for these payments.

Credit Notes where Cash Exchanged has been selected will be part of the Actual Payments totals.

0 Comments